Overview

The article highlights the substantial growth potential of chiral chromatography columns in the pharmaceutical industry, projecting a compound annual growth rate (CAGR) of approximately 4.5% from 2025 to 2030. This growth trajectory is primarily driven by the increasing demand for enantiomerically pure substances.

Significant investments in research and development for drug development, alongside advancements in separation technologies, further support this trend. Additionally, the rising emphasis on drug safety and efficacy underscores the critical role these columns play in enhancing pharmaceutical quality control and fostering innovation.

As such, the importance of high-quality scientific instruments in laboratory settings cannot be overstated.

Introduction

In the rapidly evolving landscape of pharmaceuticals, the demand for chiral chromatography columns is surging, propelled by the necessity for enantiomerically pure compounds and the relentless drive for innovation. Projections indicate a compound annual growth rate of approximately 4.5% from 2025 to 2030, positioning this sector for substantial expansion.

As pharmaceutical companies invest significantly in research and development, the need for advanced separation technologies becomes increasingly critical. However, amidst this growth, the industry grapples with challenges, notably a shortage of skilled professionals who can effectively utilize these sophisticated technologies.

Emerging markets, particularly in the Asia-Pacific region, offer new opportunities, while fierce competition among leading players underscores the importance of innovation and strategic partnerships.

This article explores the current trends, challenges, and growth prospects within the chiral chromatography column market, underscoring its pivotal role in shaping the future of drug development and quality control.

5% CAGR Growth Projection for Chiral Chromatography Columns

The asymmetric separation column market is projected to experience a compound annual growth rate (CAGR) of approximately 4.5% from 2025 to 2030. This anticipated growth is primarily fueled by the rising demand for enantiomerically pure substances in the pharmaceutical sector, alongside significant advancements in separation technologies. As the drug industry increasingly prioritizes the development of more selective and potent medications, the necessity for efficient enantiomer separation technologies becomes paramount.

Market analyses reveal a considerable increase in valuation, with projections indicating growth from USD 99 million in 2020 to an estimated USD 123 million by 2025. This trend highlights the pharmaceutical industry's escalating reliance on chiral chromatography columns for drug development and quality control processes, reflecting a broader commitment to enhancing the efficacy and safety of therapeutic agents.

Furthermore, government and corporate financing for biotechnology and drug research is propelling this industry growth, underscoring the importance of external support in fostering innovation. As noted by Manoj Phagare, Senior Research Analyst at Cognitive Market Research, "This analysis also aids companies working in the chemical sector to comprehend the existing conditions, technological progress along with environmental and safety regulations."

Additionally, customization options for market reports, such as those offered by MarketsandMarkets, empower companies in the pharmaceutical industry to obtain tailored insights that align with their strategic objectives, enabling them to navigate market challenges effectively.

R&D Investments Fuel Market Expansion in Pharmaceuticals

The pharmaceutical industry is witnessing a significant surge in R&D investments, essential for the development of new drugs and therapies. In 2022, R&D expenditures in this sector reached approximately USD 227 billion, highlighting a strong commitment to innovation. This increase in funding is anticipated to significantly boost the demand for chiral chromatography columns, as companies strive to enhance their analytical capabilities and meet stringent regulatory standards. Furthermore, the growing focus on biologics and biosimilars emphasizes the need for advanced optical technologies, as these products often require precise separation methods to ensure optimal purity and efficacy.

Historically, the Pharmaceutical Research and Manufacturers of America (PhRMA) has seen a notable increase in R&D investment, with members allocating around USD 26 billion by the early 2000s. This historical growth reflects the industry's escalating dedication to R&D, underscoring the increasing financial resources directed toward the development of new medicines. Additionally, the trend of outsourcing R&D to clinical research organizations is gaining traction among drug producers, with an increasing number engaging in this practice to manage costs while continuing to invest significantly in innovative solutions. This strategic shift not only illustrates the industry's commitment to enhancing research capabilities but also signifies a growing reliance on sophisticated analytical techniques, including the utilization of chiral chromatography columns, to meet the evolving demands of drug development.

As pharmaceutical companies continue to elevate their R&D spending, the importance of asymmetric technologies in achieving successful outcomes in drug formulation and compliance will only grow. Specific examples of businesses investing in asymmetric technologies further illustrate this trend, showcasing the sector's commitment to employing advanced separation techniques for improved drug development.

Lack of Skilled Professionals as a Market Restraint

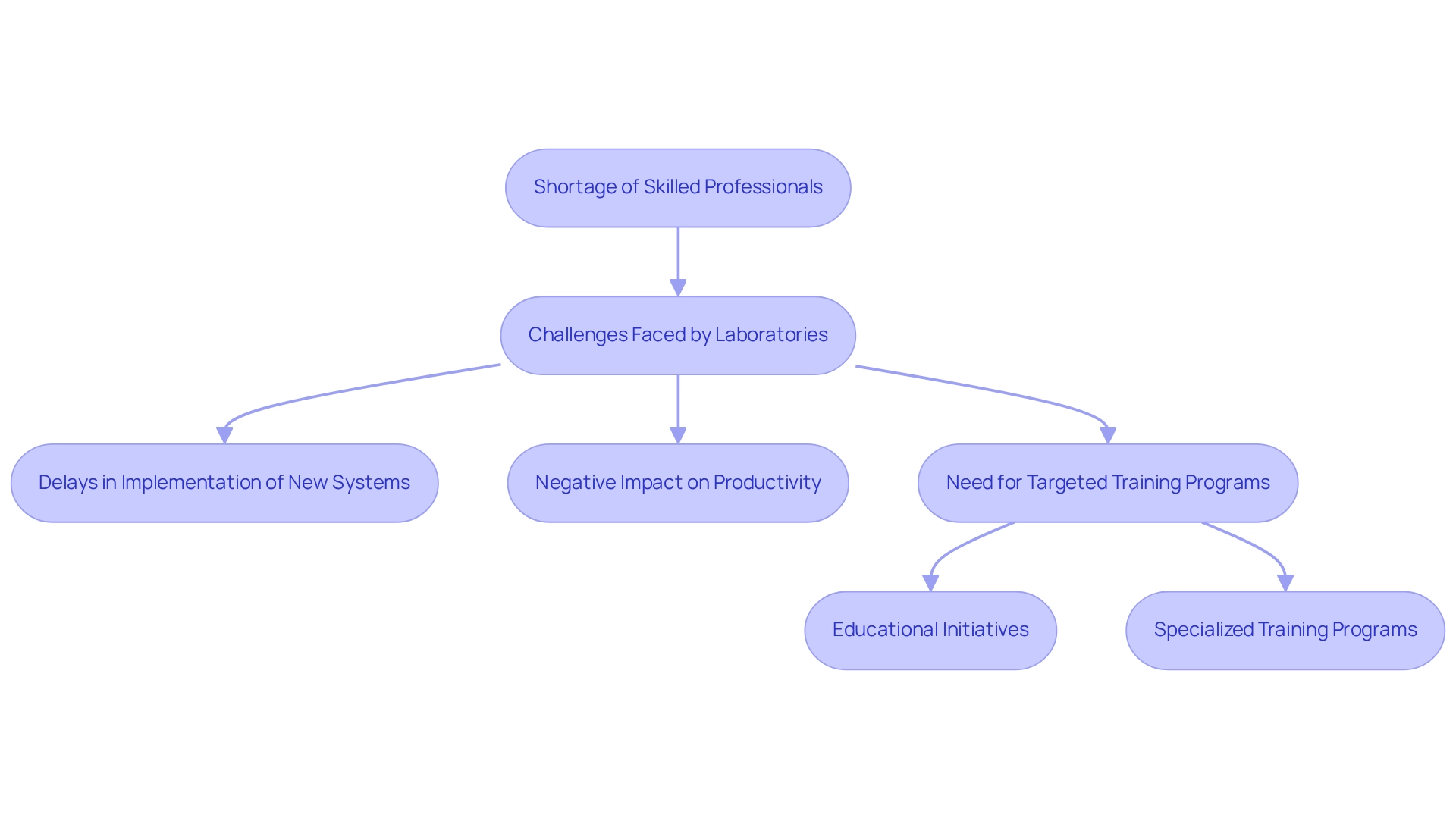

The chiral column market stands poised for expansion, yet it faces a significant hurdle: a shortage of qualified experts. The effective utilization of advanced separation technologies hinges on operators possessing specialized training and expertise. Numerous laboratories report challenges in sourcing qualified personnel, which not only hampers the adoption of innovative technologies but also negatively impacts overall productivity. For example, recent case studies indicate that laboratories lacking adequately trained staff encounter delays in the implementation of new systems, such as the latest HPLC technologies tailored for pharmaceutical applications. Notably, the launch of the Vanquish Neo UHPLC system by Thermo Fisher Scientific in July 2023 exemplifies the advancements in separation technology that necessitate skilled personnel for successful deployment.

To bridge this skills gap, targeted training programs and educational initiatives are imperative. These programs equip professionals with the crucial skills required to operate advanced separation systems effectively. Industry experts underscore the urgent need for such training, warning that without it, laboratories risk falling behind in a competitive environment where precision and efficiency are essential. Deloitte's endorsement of MarkWide Research highlights the importance of reliable research in guiding strategic decisions, further emphasizing the necessity for informed training initiatives. Addressing the skills gap transcends merely enhancing personal capabilities; it is vital for improving laboratory efficiency and ensuring that the full potential of asymmetric separation techniques is realized in drug research and development. The ongoing pandemic has further amplified the demand for accurate analytical techniques, rendering the role of skilled professionals even more critical in the current landscape.

Growth Opportunities in Emerging Markets

Developing markets, particularly in the Asia-Pacific region, are on the brink of significant growth within the sector related to enantiomers. This anticipated surge is fueled by multiple factors, including:

- A robust increase in drug manufacturing

- Escalating healthcare expenditures

- A heightened emphasis on research and development

Countries like China and India are making substantial investments in their pharmaceutical industries, which drives a strong demand for advanced analytical tools, notably chiral chromatography columns. For instance, the Chinese Government is expected to introduce new standards for 150-200 concentrated Traditional Chinese Medicine Granules (CTCMG), further energizing this sector.

As highlighted by Khushbu Jain, 'the study provides a deep-dive analysis on industry segments including small molecules, OTC, TCM, and Biologics (innovator vs. biosimilars).' Businesses that strategically position themselves in these evolving sectors stand to gain from burgeoning opportunities, enhancing their competitive advantage while contributing to advancements in medical research and healthcare.

JM Science Inc. is pivotal in this landscape, providing premium scientific instruments such as the AQ-300 Coulometric and AQV-300 Volumetric Karl Fischer Titrators, which are essential for drug and medicine testing in accordance with Japanese Pharmacopoeia. By maintaining partnerships with leading brands like Agilent Technologies and Thermo Fisher Scientific, JM Science ensures the delivery of high-quality solutions tailored to client needs, further facilitating the growth of the healthcare industry.

Competitive Landscape and Market Share Analysis

The column sector for separation is marked by intense competition among leading companies such as Agilent Technologies and Thermo Fisher Scientific. These industry pioneers are driving innovation, continuously broadening their product offerings to improve selectivity and separation efficiency. Recent breakthroughs, including ultra-high-performance liquid separation techniques and hybrid stationary phases, have notably enhanced analytical capabilities, allowing drug laboratories to achieve faster and more precise results.

Market dynamics are shaped by technological advancements, competitive pricing strategies, and robust customer support services. As the industry evolves, companies that emphasize innovation and a customer-centric approach are poised to secure a competitive advantage.

Current share analysis reveals that North America dominates the enantiomer separation sector; however, the Asia-Pacific region is anticipated to experience the most rapid growth, projected at a CAGR of 4.5%. This increase is primarily driven by rising investments in pharmaceutical research and development, coupled with heightened manufacturing activities. The focus on drug safety and efficacy further propels the demand for solutions utilizing chiral chromatography columns, underscoring the importance of strategic partnerships and collaborations among key players to enhance product offerings and market presence. Notably, Sartorius has recently finalized the acquisition of the Novasep chromatography division, illustrating the ongoing consolidation and innovation within the industry.

Conclusion

The chiral chromatography column market is poised for substantial growth, with a projected compound annual growth rate of approximately 4.5% from 2025 to 2030. This upward trajectory is fueled by the increasing demand for enantiomerically pure compounds in pharmaceuticals, as well as advancements in chromatography technologies. As pharmaceutical companies ramp up their research and development investments, the necessity for effective chiral separation techniques becomes paramount, highlighting a commitment to enhancing drug efficacy and safety.

Nevertheless, the industry grapples with significant challenges, particularly a shortage of skilled professionals adept at operating advanced chromatography systems. In the absence of sufficient training programs, laboratories risk lagging in the adoption of innovative technologies. Bridging this skills gap is crucial for boosting productivity and fully harnessing the potential of chiral chromatography in drug development.

Emerging markets in the Asia-Pacific region present promising growth opportunities, driven by escalating investments in pharmaceutical manufacturing and healthcare. Companies that strategically penetrate these markets can secure a competitive advantage while contributing to advancements in pharmaceutical research.

The intense competition among leading players underscores the necessity for innovation and customer-centric strategies. As the industry evolves, those prioritizing technological advancements and strategic partnerships will be optimally positioned to satisfy the increasing demand for chiral chromatography solutions. Ultimately, navigating these trends and challenges will be essential for the future of drug development, reinforcing the indispensable role of chiral chromatography in the pharmaceutical landscape.